The smart Trick of Pkf Advisory That Nobody is Talking About

Table of ContentsFacts About Pkf Advisory RevealedSee This Report about Pkf AdvisoryTop Guidelines Of Pkf AdvisoryA Biased View of Pkf AdvisoryWhat Does Pkf Advisory Do?Pkf Advisory Fundamentals ExplainedThe 3-Minute Rule for Pkf AdvisoryExcitement About Pkf Advisory

I have a whole lot of respect for accountancy leaders who take pride in the way they manage every element of their firm. Let's have a look at a couple of reasons that optimizing efficiency in your bookkeeping department is necessary. The first reason efficiency is vital involves time and price savings.

The Ultimate Guide To Pkf Advisory

Reliable accounting processes make sure that information is precise and consistent, reducing the risk of mistakes and monetary inconsistencies. Make use of these actions to establish efficient accountancy processes in your bookkeeping department: Recognize the existing process and its drawbacks. Map out the current process to identify the actions involved, the inputs and outputs, and the principals included.

Identify traffic jams, redundancies, and inadequacies while doing so. Get input from several sources to guarantee a complete viewpoint is stood for. Based on the evaluation of the current process the accountancy division should create a structured procedure that is straightforward, simple, and simple to comply with. Connect the procedure to all key gamers with training, workshops, or composed instructions.

The audit division need to guarantee that everybody associated with the procedure understands their roles and responsibilities and follows the brand-new procedure. The process must then be monitored frequently to ensure that it is effective and effective. Any concerns or obstacles that emerge need to be attended to promptly to ensure that the procedure remains to run efficiently.

By having prompt and accurate financial information, accounting departments can make it possible for monitoring and capitalists to make far better choices. There are numerous instances of accounting function efficiency assisting in critical decision-making. Let's check out one of the most vital sorts of decisions organizations make: Accounting decisions can straight influence the of a company. Decisions associated with budgeting, capital management, and investments can all impact the total monetary health of the company.

Fascination About Pkf Advisory

A 2nd instance would certainly entail choices about. Firms are expected to follow government and state regulations and legislations connected to financial reporting, tax filings, and various other economic issues at all times. Failure to follow these guidelines results in penalties, fines, and various other legal obstacles. Therefore, prompt and accurate details is vital to maintain positive, ongoing compliance in all aspects of the business.

Our group of knowledgeable accountancy professionals is ready to come together with you to maximize performance and assistance attain company goals. He brings two years of dynamic experience in Controller, CFO, and General Administration functions with privately held firms, and has a broad viewpoint from functioning in environments ranging from start-ups to multi-generational mid-market business with revenue in excess of $100M. Eric holds a Bachelor's Degree in Business Administration from Washington State College with a focus in Accounting and Money.

The term accounting is extremely typical, particularly during tax period. But prior to we dive into the importance of accounting in company, let's cover the basics what is bookkeeping? Audit describes the systematic and in-depth recording of monetary transactions of a service. There are numerous types, from making up small companies, federal government, forensic, and monitoring audit, to accounting for firms.

Organization fads and estimates are based on historic economic data to maintain your operations profitable. Organizations are needed to file their monetary declarations with the Registrar of Firms (PKF Advisory).

Pkf Advisory Fundamentals Explained

Business proprietors will certainly tend to look for professional aid only when they are faced with tax obligation target dates. Accountants are essential in a service's day-to-day financial administration.

Running a retail company is interesting but difficult. With so many relocating parts, it's very easy to really feel overwhelmed. They are important for any kind of retail business that wants to thrive.

Pkf Advisory Fundamentals Explained

This includes accounting, tax obligation compliance, and monetary coverage. Proper bookkeeping in retail company aids owners make educated choices. It also guarantees that the service continues to be certified with laws and laws. Managing accounting and financial resources can be hard for tiny retail local business owner. These challenges can impact the health and growth of the service.

Recognizing tax obligation laws can be frustrating. Tiny stores frequently have a hard time to keep up with transforming policies.

Disorganized financial records produce confusion. Without exact records, monitoring costs, sales, and revenues comes to be tough. This inefficiency can impede decision-making. Many little stores lack strong economic planning. Without a clear strategy, it is wikipedia reference hard to establish objectives or allocate resources successfully. This can limit development chances and decision-making. Determining financial risks is testing for small merchants.

Facts About Pkf Advisory Uncovered

Without a danger monitoring strategy, these surprises can hurt the company. Meeting lawful demands is important for small organizations.

Navigating tax laws can be hard for retail business proprietors. This makes it hard to maintain up, specifically for tiny businesses with limited resources. Retail services have to deal with various tax obligations, such as sales tax, income tax, and payroll tax obligation.

The Definitive Guide for Pkf Advisory

Errors in tax obligation filings can bring about pricey fines. Specialist accountants assist guarantee that your tax returns are exact and sent on time. This minimizes the threat of errors and helps you avoid the visit here stress and anxiety that comes with audits or fines. Financial forecasting and planning are crucial for retail services.

Outsourcing this work to professionals brings several benefits: Expert accountants can produce clear economic projections. They help you see where your organization is going. This clearness guides your decisions and maintains you aligned with your lasting goals. Exact forecasts allow you to allot your sources intelligently. You can decide where to spend money and manpower without wasting them on locations that won't yield great returns.

Some Known Details About Pkf Advisory

They show that your company is arranged and has a strategy for growth. Money flow is often called the lifeblood of a retail organization.

Outsourcing this work to professionals brings numerous advantages: Expert accountants can create clear monetary estimates. They aid you see where your company is going.

By acknowledging these dangers early, you can get ready for financial declines or unanticipated expenses. Well-prepared economic estimates thrill financiers and loan providers. They reveal that your organization try this out is arranged and has a strategy for development. Cash money flow is usually called the lifeblood of a retail business. It refers to the motion of cash in and out of your business.

Ashley Johnson Then & Now!

Ashley Johnson Then & Now! Michael Jordan Then & Now!

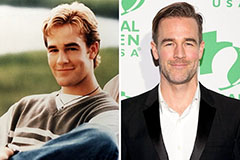

Michael Jordan Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Mary Beth McDonough Then & Now!

Mary Beth McDonough Then & Now! Nadia Bjorlin Then & Now!

Nadia Bjorlin Then & Now!